I’ve been investing in the stock market for about a decade now while working in content marketing.

Over time, I’ve realized that the same principles that make you successful in the stock market also make you successful in Search Engine Optimization (SEO). They are different worlds with remarkably similar logic.

Here are 9 observations.

Compounding is your best friend

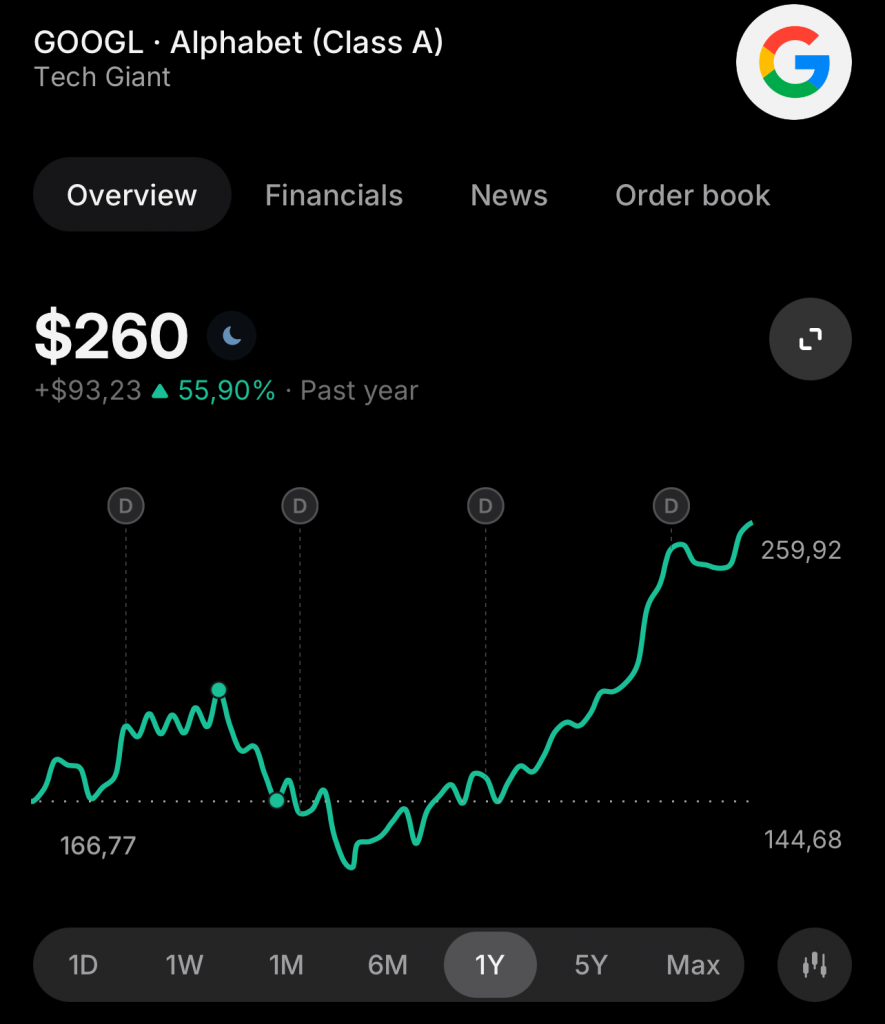

In investing, compounding is what turns small, consistent actions into massive long-term results. You don’t get rich by buying one stock and waiting a month. You get rich by staying in the market for years and letting returns pile on themselves.

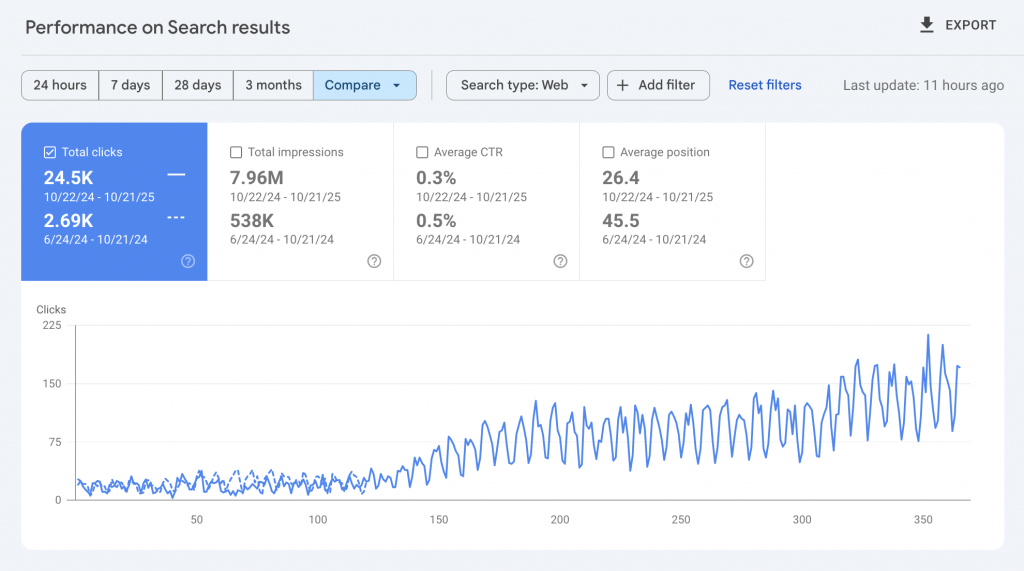

SEO works the same way. You can’t publish a few blog posts and expect miracles. It takes months, sometimes years, of consistent publishing before the real payoff begins.

That’s because Google and other search engines reward longevity and relevance. Domain age, authority, and steady updates compound over time, just like dividends reinvested in your portfolio.

You can’t time the market — or the algorithm

Trying to time the market is a losing game. You might get lucky once or twice, but even professional traders can’t predict when the next spike or crash will hit (80% of traders lose money).

SEO is no different. Chasing trends or reacting to every news event might give you a temporary traffic bump, but it’s rarely sustainable. Long-term positioning wins.

Instead of trendjacking, build evergreen content that keeps performing year after year. Think of it as buying and holding index funds rather than gambling on penny stocks.

Coverage equals returns

The more stocks you own, the more chances you have to benefit from winners. The same goes for SEO. The more keywords and topics you cover in your niche, the more entry points people have to find you.

When you build topic clusters — groups of related articles linking to each other — you’re essentially diversifying your keyword portfolio.

In investing, that’s what ETFs and mutual funds do. They spread your risk across sectors while keeping you exposed to growth opportunities.

| SEO concept | Investing equivalent |

| Topic cluster | ETF or mutual fund |

| Keyword diversification | Portfolio diversification |

| Domain authority | Market reputation |

| Backlinks | Partnerships or leverage |

| Regular publishing | Regular contributions |

Consistency beats intensity

It’s better to invest small amounts regularly than to dump a huge sum once and disappear. That’s called dollar-cost averaging — it smooths out the market’s ups and downs.

SEO rewards the same behavior. Regular content updates and publishing activity tell Google your site is alive and credible. A steady drumbeat of content helps your traffic trend upward over time.

Sporadic publishing, like lump-sum investing, usually results in volatility.

Leverage works both ways

Leverage in investing means using borrowed money to increase potential returns (like in CFD trading). But it also magnifies losses if things go wrong.

In SEO, leverage shows up when other sites link to yours. A link from a high-authority site acts like borrowed credibility, boosting your rankings faster than you could on your own.

But just like bad debt, low-quality backlinks can backfire. Spammy links can drag your site down just as bad trades can wipe out your portfolio gains.

Both lead to passive returns

When your SEO engine is humming, traffic and leads come in even when you’re asleep. The same is true of a good stock portfolio. Dividends and capital gains work in the background to grow your wealth. With time, both can start covering your expenses.

Some investors call that “cash flow matching.”

In SEO, it’s the moment when your website becomes a consistent source of qualified leads that support your business without extra ad spend. We aim for this goal with all our clients.

Analytics keep you honest

In both SEO and investing, the numbers tell the truth. You have to watch the graphs: traffic trends, rankings, conversion rates, stock prices, and returns. You can’t improve what you don’t measure.

Regular reviews help you spot what’s working, what’s lagging, and where to adjust. Maybe an article’s rankings are slipping and need an update. Maybe one stock’s dragging your portfolio down and needs replacing.

The logic is the same: data, not emotion, drives smart decisions.

Past performance isn’t a guarantee

Your best-performing stock last year might crash this year. Your top-ranking blog post might fall off page one after a Google update. Both remind us that the game changes constantly. Markets react to new regulations, and algorithms react to new signals.

The antidote is the same in both worlds: adapt and rebalance. Keep your fundamentals strong, your strategy long-term, and your mindset patient.

The same brain wins both games

If you understand SEO deeply, you’d probably do well in the stock market. You already know how to think long-term, diversify risk, track metrics, and compound small wins over time.

Likewise, if you’re an investor, you’d feel right at home with SEO. Both reward patience, data literacy, and strategic calm.

Whether it’s your website or your portfolio, the same rule applies: time in the game beats timing the game.

If you need help building a long-term portfolio of content that compounds into leads and revenue for your business, get in touch today.

Mo is the founder of Column, a technical research and content agency. Connect with him on LinkedIn.