TL;DR: We’ve compiled the top banking and payments white paper PDFs of 2024 with key insights into digital finance’s future.

From central bank digital currencies to real-time payments, these resources offer a snapshot of the industry’s cutting-edge trends.

Looking to write your own white paper? Learn more about our white paper writing service.

To help you navigate the complex world of banking and payments, we’ve curated a list of the top 19 banking & payments white paper PDFs to read in 2024.

Authored by leading organizations, researchers, and experts, these white papers provide comprehensive insights into the key developments, challenges, and opportunities that lie ahead.

Here are the organizations and topics in store:

- Deserve: Business card programs

- Deutsche Bank & KPMG: Digital payments

- Digital Dollar Project

- Federal Reserve: Central Bank digital currency

- Fiserv: Instant payments

- IBM: 2023 Global Outlook

- Lipis Advisors: Interoperability

- MIT: Accountability and traceability

- RingCentral: Compliant communications

- Singapore Monetary Authority: Purpose Bound Money

- SIX: Invoicing

- Solaris: Embedded finance

- Swiss Bankers Association: Deposit Token

- Temenos: Asia-Pacific trends

- Thales: Transit cards

- Tis: Treasury cost-cutting

- Treezor: Embedded finance

- UDPN: Interoperability

- WEF: Central Bank digital currency

Enjoy these white papers around digital transformation, interoperability, and the future of banking and payments.

Deserve: Business card programs

Organization name: Deserve, Inc.

White paper title: “Building a Business Card Program in Today’s Digital-First Landscape”

White paper publication year: 2023

Summary:

The financial services industry experienced a significant shift towards digital transformation due to the impact of COVID-19.

Even skeptics of digital technology had to embrace it for standard monthly transactions.

This rapid transformation influenced technology prioritization and business objectives for many financial institutions (FIs).

Today, a large percentage of FIs have either deployed digital transformation solutions at scale (18%) or are partially deployed (61%).

Cornerstone Advisors predicts that 76% of banks and 87% of credit unions have launched a digital transformation strategy or initiative by 2023.

The focus on digital technology is now crucial for attracting and retaining customers in the industry.

This white paper explores:

- The key points for selecting a digital card program platform.

- The top three attributes SMBs seek in card solutions.

- Identifying how a card program needs to be structured and creating criteria for technology partner evaluation.

Download the white paper here.

Deutsche Bank & KPMG: Digital payments

Organization name: Deutsche Bank & KPMG

White paper title: “Digital Payments and Treasury: An Enabler of Long-Term Growth”

White paper publication year: 2023

Summary:

As e-commerce continues to grow, digital payments — the facilitator of these online sales — have become a top priority for merchants.

There is increasingly a focus on providing an intuitive, fast and seamless experience for customers.

As businesses look to embrace digital payment strategies, there is an opportunity for treasury to take a more holistic approach and help to improve the end-to-end payment workflow, enterprise resource planning (ERP) integration and material and distribution management.

This white paper reviews the opportunity for treasurers and outlines how treasury can become an important business enabler, helped by banks and technology providers.

Download the white paper here.

Digital Dollar Project

Organization name: Digital Dollar Project

White paper title: “Revisiting the Digital Dollar Project’s Exploration of a U.S. Central Bank Digital Currency”

White paper publication year: 2023

Summary:

The Digital Dollar Project is a non-profit organization focused on researching and exploring the potential benefits and challenges of a U.S. central bank digital currency (CBDC), or “digital dollar.”

They bring together private sector, academic, and non-profit leaders to inform the national consideration of a digital dollar and understand global CBDC developments’ implications for Americans.

The project gained momentum during the global pandemic and economic recession, which highlighted the need to modernize the financial infrastructure and ensure broader financial inclusion.

The rise of CBDCs is no longer theoretical, with many central banks actively exploring and even deploying their CBDCs, driven in part by private sector-led education and exploration efforts.

This white paper provides a snapshot of the global CBDC landscape, revisits the Digital Dollar Project’s “champion model” of a potential digital dollar, and looks ahead to the next stage in the evolution of CBDC development.

Download the white paper here.

Federal Reserve: Central Bank digital currency

Organization name: Board of Governors of the Federal Reserve System

White paper title: “Money and Payments: The U.S. Dollar in the Age of Digital Transformation”

White paper publication year: 2022

Summary:

The Federal Reserve has evolved its payment technologies over the years.

It has gone from establishing a national check-clearing system and automated clearinghouse (ACH) system to committing to building the FedNowSM Service, a real-time interbank payments system.

As technological advances introduce new private-sector financial products like digital wallets, mobile payment apps, and cryptocurrencies, central banks worldwide, including the Federal Reserve, have been exploring the potential benefits and risks of issuing a central bank digital currency (CBDC).

The Federal Reserve’s study of CBDC is guided by a focus on providing benefits to the economy, ensuring financial stability, privacy, and security, and complementing existing forms of money and financial services.

Concurrently, the Federal Reserve is working to enhance its current payment technologies to meet the changing needs of the financial industry and consumers while staying adaptable to emerging trends in the financial landscape.

This white paper is the first step in a public discussion between the Federal Reserve and stakeholders about central bank digital currencies (CBDCs).

Download the white paper here.

Fiserv: Instant payments

Organization name: Fiserv

White paper title: “The Convergence of Instant Everywhere”

White paper publication year: 2022

Summary:

Real-time payments are revolutionizing the financial landscape, providing consumers with greater financial control and confidence.

Financial institutions and their competitors are prioritizing instant payment rails to enhance the payments journey and meet consumer preferences.

Open banking and Request to Pay solutions are already leveraging instant payment rails, benefiting both payees and payers.

The industry is approaching a tipping point where instant payment systems will become the dominant rail.

While it may seem like instant payments emerged suddenly, the first system was developed in Japan in 1973. Today, there are over 60 instant payment systems worldwide.

As technology and consumer demand continue to drive the evolution of payments, financial institutions must be prepared to embrace this transformative change.

They must adapt to the increasing prominence of instant payments, ultimately replacing traditional legacy channels.

This white paper explores how this convergence will benefit payers, payees and the providers that support them.

Download the white paper here.

IBM: 2023 Global Outlook

Organization name: IBM

White paper title: “2023 Global Outlook for Banking and Financial Markets”

White paper publication year: 2023

Summary:

In an uncertain world, financial services institutions must be flexible, and digital business models and architectures allow for this adaptability in hybrid cloud environments.

However, traditional models and legacy architectures limit the use of data and AI.

Achieving healthier financial performance depends on business and technology leaders working together as equals. Technology leaders should actively participate in setting business strategy.

Industry-wide profitability has faced challenges in recent years, and changing how organizations work can help address this.

The next crisis could be operational in nature, and as organizations become more digitally interconnected, a secure digital foundation becomes increasingly crucial.

This white paper discusses new impacts and strategies for growth and performance, risk and compliance, and cost and efficiency.

Download the white paper here.

Lipis Advisors: Interoperability

Organization name: Lipis Advisors

White paper title: “Enabling Offline Payments in an Online World: Interoperability”

White paper publication year: 2023

Summary:

Interoperability is a crucial aspect of successful payment systems.

It broadens the adoption of electronic payments, reduces market fragmentation risks, fosters competition and innovation, and promotes inclusivity.

Real-time payment systems like Pix in Brazil, Swish in Sweden, and UPI in India have achieved widespread success by implementing innovative approaches to enable seamless interoperability.

For instance, Swish allows users to connect their bank accounts to the platform, facilitating transfers between different banks and financial institutions.

UPI and Pix enable instant payments across the ecosystem, irrespective of the user’s chosen bank or third-party provider.

These systems benefit from standardized messaging, APIs, QR codes, and common scheme rules established through regulator- and industry-led efforts.

This white paper delves into the challenges of maximizing interoperability in an offline context, introducing new frameworks to understand interoperability between online and offline systems.

It explores the key design considerations for offline systems to enhance interoperability from the beginning, and also highlights India’s pioneering role in driving innovations related to payment interoperability.

Download the white paper here.

MIT: Accountability and traceability

Organization name: MIT

White paper title: “Accountability and Traceability White Paper and Research Roadmap”

White paper publication year: 2023

Summary:

The MIT Future of Data Initiative aims to develop and implement consumer-empowering and accountable systems that ensure trusted and traceable use of personal data at scale.

The initiative brings together computer science and Internet policy researchers along with leading commercial enterprises from various sectors to address privacy and data governance challenges.

Privacy laws have raised expectations for organizations handling personal data, but consumer trust in data handlers is declining, and regulators face enforcement challenges.

MIT aims to bridge the gap between privacy law requirements and data system capabilities.

It will do this by identifying and implementing technical infrastructure that enables trustworthy and lawful handling of personal data, emphasizing traceability, accountability, and scalability.

MIT’s research has identified new system architectures and software engineering techniques that can support privacy compliance, accountability, and transparency.

The initiative seeks widespread adoption and interoperability of these new technical approaches to enhance consumer trust in modern data services through cross-disciplinary efforts involving businesses, software vendors, regulators, and civil society.

This white paper describes the goals and broad design requirements of these approaches and systems.

Download the white paper here.

RingCentral: Compliant communications

Organization name: RingCentral Inc.

White paper title: “Ensuring Compliant Communications in Financial Services”

White paper publication year: 2023

Summary:

The COVID-19 pandemic has permanently altered the communication habits and expectations of both employees and customers.

The shift towards a multichannel communication landscape is irreversible, and financial institutions must adapt to these changes.

Regulators will eventually catch up with these transformations, making it essential for financial institutions to empower employees to use multi-channel communications securely and meet customer preferences for communication methods.

A cloud-based unified communications platform should be a central component of a financial institution’s strategy.

It should be designed to enable seamless communication across any time, channel, or device, while ensuring strict compliance with regulations.

This approach will help position financial institutions for long-term success in the evolving communication landscape.

This white paper outlines how unified communications platforms facilitate and ensure compliance, collaboration, and customer engagement.

Download the white paper here.

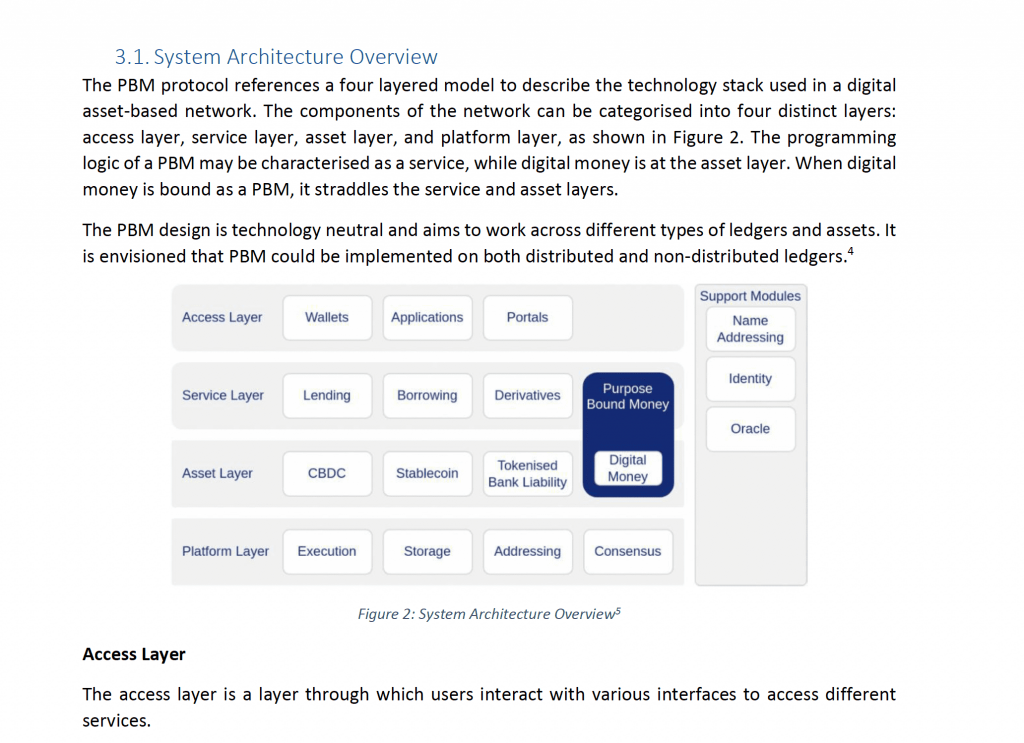

Singapore Monetary Authority: Purpose Bound Money

Organization name: Monetary Authority of Singapore

White paper title: “Purpose Bound Money (PBM): A Technical White Paper”

White paper publication year: 2023

Summary:

Digital assets are digital representations of value, encompassing ownership of financial assets and real-world assets.

The digital asset ecosystem holds the potential to improve transaction efficiency, promote financial inclusion, and unlock economic value.

Central bank digital currencies (CBDCs), tokenized bank liabilities, well-regulated stablecoins, and smart contracts could serve as the medium of exchange within this ecosystem.

However, digital monies must demonstrate their utility beyond existing e-payment systems.

Programmability is a touted advantage of digital money, but it should not compromise its role as a medium of exchange or lead to liquidity fragmentation.

This paper introduces the concept of Purpose Bound Money (PBM) as a way to direct money towards specific purposes without requiring direct programming.

It provides a technical overview of PBM and its potential extension to various use cases beyond MAS’ Project Orchid.

Download the white paper here.

SIX: Invoicing

Organization name: SIX

White paper title: “Future of Invoicing”

White paper publication year: 2023

Summary:

In Switzerland, invoicing is a central component of the payment industry, coexisting with other payment methods like cash, debit/credit cards, and mobile payment solutions.

In 2021, Switzerland reported 1.27 billion outgoing payments with a total volume of CHF 8.09 trillion.

Domestic transactions accounted for the majority, while cross-border transactions were a smaller proportion.

Invoicing enjoys significant popularity among Swiss consumers, with 49% of remote transactions made through mobile devices, and 22% of Swiss respondents choosing invoicing as their preferred payment method in a European survey.

Modern invoicing procedures offer advantages such as efficient end-to-end processes and reliable payment flows for invoice issuers.

This white paper provides invoice issuers and invoice recipients, as well as the interested public in Switzerland with an overview and to outline future prospects for the different approaches to invoicing.

Download the white paper here.

Solaris: Embedded finance

Organization name: Solaris

White paper title: “The Future of Embedded Finance”

White paper publication year: 2023

Summary:

In the rapidly evolving digital world, trends such as buy-now-pay-later (BNPL) and digital bank accounts are becoming standard features.

Startups, e-commerce companies, and established incumbents are all seeking solutions to engage customers with tailor-made financial services.

This white paper explores the question of whether all players in this market will succeed and delves into the factors that will determine the winners and losers in the embedded financial services landscape.

Download the white paper here.

Swiss Bankers Association: Deposit Token

Organization name: Swiss Bankers Association

White paper title: “The Deposit Token: New Money for Digital Switzerland”

White paper publication year: 2023

Summary:

The Swiss Bankers Association (SBA) is investigating the concept of a digital currency called the “Deposit Token” (DT), a stablecoin based on distributed ledger technology (DLT).

The goal is to promote innovation, enhance efficiency, and strengthen Switzerland’s position as a leading hub for digital currencies.

This white paper explores how Swiss banks can support the country’s economy in settling transactions in digital assets and facilitating payments in a digitalized economy.

It discusses three potential DT variants, legal considerations, and cooperation with central banks on digital payment projects.

It also considers the progress in instant payments and pilot projects for “wholesale CBDCs,” which could impact the efficient and secure settlement of transactions between banks and influence digital means of payment for clients.

Download the white paper here.

Temenos: Asia-Pacific trends

Organization name: Temenos

White paper title: “Payments in 2023 and Beyond: Key trends for Asia-Pacific”

White paper publication year: 2023

Summary:

Towards the end of 2022, the world began its recovery from the pandemic, with countries reopening their borders and facing global macroeconomic and geopolitical challenges.

Higher inflation has led central banks to implement measures that increase interest rate margins, resulting in higher income for banks.

Despite challenges, the Payments industry experienced a rebound in revenue across different markets in 2022, with growth exceeding expectations and reaching a high not seen since 2017.

A McKinsey Global Payments report predicts further revenue growth in Payments for the coming years.

The Asia-Pacific region is expected to see the highest growth in cashless transaction volumes, accounting for over 50% of global volumes.

However, incumbent banks may face challenges from alternative payment methods introduced by Big Tech, Telecom giants, and retailers.

This white paper explores some of the key payments trends in the Asia-Pacific markets which will dominate in 2023 and beyond.

Download the white paper here.

Thales: Transit cards

Organization name: Thales

White paper title: “Transit Cards in Mobile Wallets: More Than Just Another Digital Card”

White paper publication year: 2023

Summary:

The widespread adoption of digital cards over physical ones has become a common practice, with people storing their cards in digital wallets and disregarding the physical versions.

Cities like Hong Kong, Paris, Los Angeles, and San Francisco are leading the way by enabling urban travelers to digitize their transit cards in mobile wallets.

However, it is crucial to recognize that digital cards offer more than just replicas of their physical counterparts.

In digital wallets, payment cards are expected to provide real-time transaction updates, while digital transit cards offer user-friendly smartphone services.

The mobile wallet has emerged as the primary point of interaction between card issuers and users, serving as a platform for additional transit-related services and facilitating direct communication between transit operators and travelers.

This white paper explores the unique value proposition of transit cards in mobile wallets and how they differ from traditional payment or loyalty cards.

Download the white paper here.

Tis: Treasury cost-cutting

Organization name: Tis

White paper title: “5 Ways That Treasury Can Save Money & Boost Revenue in 2023”

White paper publication year: 2023

Summary:

Modern treasury teams hold a crucial role in overseeing global cash, payments, and working capital activities, and they play a vital part in controlling operational, financial, and technological costs for their companies.

Their responsibilities include monitoring and reducing banking and transaction fees, preventing payments fraud, optimizing daily liquidity, and developing short-term debt or investment strategies.

With limited headcount and increasing responsibilities, treasury teams must focus on projects that will have the most significant impact on their company’s revenue and cost-saving efforts.

In today’s volatile economic environment, where cost-cutting and revenue maximization are paramount, treasury groups will likely undertake various cost-saving and revenue-boosting projects in the coming months and years.

This white paper highlights five strategic ways in which treasury teams can positively impact their company’s bottom line in 2023.

Download the white paper here.

Treezor: Embedded finance

Organization name: Treezor

White paper title: “Embedded Finance: 5 reasons to embrace it”

White paper publication year: 2023

Summary:

Embedded finance refers to the use of technical tools by non-financial businesses to offer financial services to their customers.

They achieve this by partnering with third-party providers, like Treezor, which integrate their own technology into the businesses’ solutions.

This integration process is relatively quick, taking just a few months to add financial features to the customer journey.

The Banking-as-a-Service (BaaS) model enables these businesses to access licenses, core banking services, and regulatory compliance from their BaaS partners.

With the advent of the internet and smartphone apps, the development of embedded finance accelerated, facilitated by Open Banking regulations like PSD2 in Europe, which opened banks’ ecosystems to third-party providers through APIs.

This white paper defines the main trends in embedded finance, which today allows companies to rapidly integrate the payment function into their value chain.

Download the white paper here.

UDPN: Interoperability

Organization name: UDPN

White paper title: “Interoperable payment infrastructure for the digital currencies of tomorrow”

White paper publication year: 2022

Summary:

The Universal Digital Payments Network (UDPN) aims to meet the growing need for interoperability among Central Bank Digital Currencies (CBDCs) and regulated stablecoins.

With the rise of digital currencies and the need for modernized payment infrastructures, central banks are exploring CBDCs and regulated stablecoins as potential solutions for improved financial inclusion, speed, transparency, and reduced costs.

However, the lack of an agreed messaging standard for digital currencies poses a challenge to their widespread adoption.

The UDPN addresses this issue by offering a global payment messaging network that supports seamless cross-border digital currency payments across different protocols and systems.

This white paper outlines how the UDPN is building that universal interoperability network.

Download the white paper here.

WEF: Central Bank digital currency

Organization name: WEF

White paper title: “Central Bank Digital Currency Global Interoperability Principles”

White paper publication year: 2023

Summary:

In 2023, the exploration of central bank digital currency (CBDC) has seen significant growth, with over 100 countries actively engaging in research and development or launching CBDC initiatives.

This surge in exploration highlights the recognition of CBDCs as a transformative tool in the future of digital payments.

To ensure successful implementation and promote interoperability in domestic and cross-border payment systems, global coordination becomes crucial.

The World Economic Forum’s CBDC Regional Roundtable series facilitated multi-stakeholder dialogues on CBDCs, promoting knowledge sharing across regions and encouraging globally interoperable CBDC systems.

This publication gathers insights from these discussions to identify unique aspects affecting CBDC design in different regions and establish a series of interoperability principles.

Download the white paper here.

Wrap up

The banking & payments white paper PDFs highlighted above provide valuable insights, analyses, and strategies from leading organizations, researchers, and experts.

They explore digital transformation, interoperability, compliance, instant payments, and more, offering a comprehensive view of the current state and future prospects of the industry.

Download them to stay ahead of the curve, embrace the opportunities, and contribute to shaping the future of banking and payments in 2023 and beyond.

Drive change through thought leadership

Interested in crafting insightful and impactful white papers for your organization?

Whether you’re exploring new trends in banking, payments, or any other industry, professional white paper writing can make all the difference.

At Column Content, we specialize in creating white papers that not only inform but also engage and inspire your audience.

Click here to learn more about our white paper writing service and take the first step towards transforming your ideas into influential thought leadership content.