REPORT

State of Motshelo in Botswana 2025

How Batswana save together today

We surveyed 140 Batswana to uncover how metshelo are used, the challenges they face, and the appetite for digital solutions that keep the spirit alive.

What’s next for metshelo?

Motshelo (plural: metshelo) participation remains central to financial life in Botswana. But late payments, poor records, and trust issues are common. This report shows where metshelo stand today and what it will take to modernize without losing their cultural power.

Inside the report

Who is using a motshelo today

The most common types of groups

Key frustrations and trust issues

How open people are to digital solutions

The top features Batswana want in an app

Barriers, risks, and regulatory gaps

Opportunities for fintech, banks, and cooperatives

Motshelo statistics

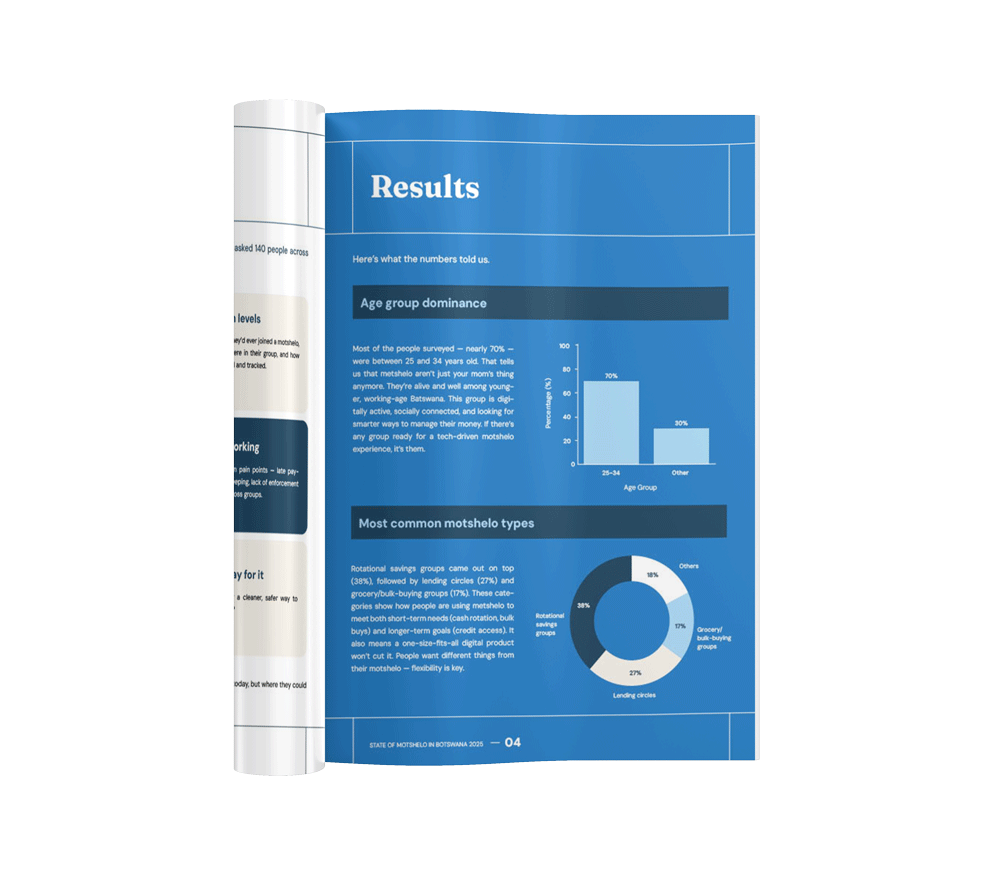

The survey of 140 participants revealed clear trends:

70% were aged 25–34, showing strong youth engagement

38% use rotational savings groups, the most common type

53% gave a perfect score for interest in a digital motshelo app

Over 75% want one place to track finances and over 65% want automated savings

These numbers show a digitally ready audience, provided key issues are solved.

Who should read this?

Fintech founders exploring new product ideas

Bank executives seeking community-driven services

Policy leaders shaping financial inclusion

Community leaders managing local metshelo

Researchers studying informal financial systems

If you care about the future of savings culture in Botswana, this report is for you.

This report is for you if you’ve ever asked:

How do young Batswana actually use metshelo?

What problems frustrate members the most?

Is there appetite for a digital motshelo platform?

What features would people pay for?

Where do risks and opportunities lie for financial players?