What an Ideal Customer Profile Really Is

An Ideal Customer Profile (ICP) describes the type of company that is the best possible fit for your product. Not just a company that could buy from you, but the kind that consistently sees value, adopts quickly, and becomes profitable over time.

This phase of your lead generation strategy focuses on the organisation itself — its structure, environment, challenges, and buying behaviour — not the individual people inside it. That’s where many teams confuse ICPs with buyer personas. A buyer persona helps you understand a specific decision-maker or user; an ICP tells you whether their company is even worth engaging in the first place.

When your ICP is clear, you’re no longer guessing which accounts to chase. You know exactly which organisations benefit most from your solution and why. This becomes the reference point for every decision, from who you target, to how you craft your message, to which opportunities your sales team prioritises.

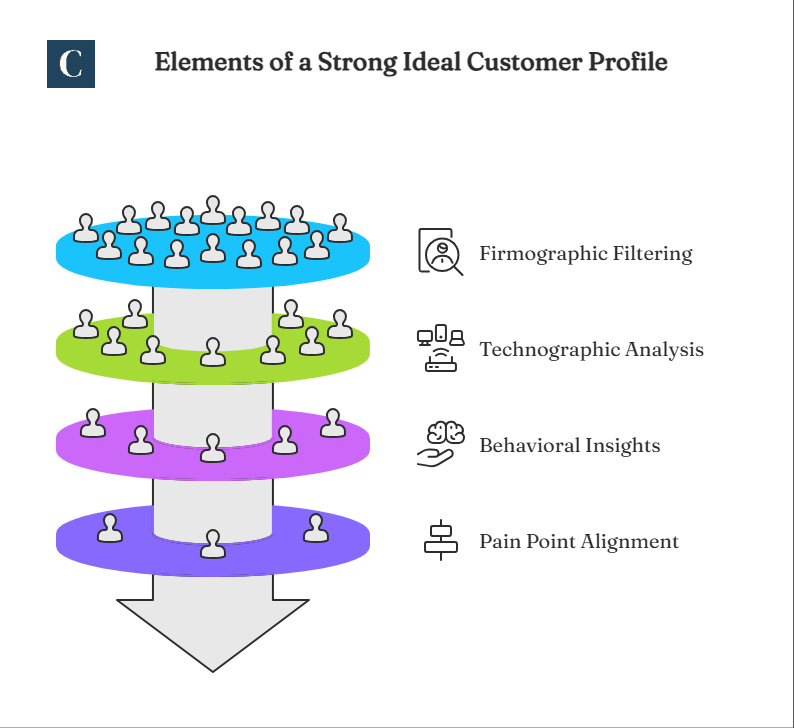

The Core Building Blocks of a Strong Ideal Customer Profile

A strong ICP goes beyond simple filters like industry or company size. It captures the deeper traits that signal whether a company is truly built for your solution. These traits fall into a few categories. That includes:

Firmographic data

Firmographics are the basics like industry, revenue, headcount, region, business model. They help you filter, but they only tell part of the story.

For example, Shopify began by serving independent online shops that needed a simple way to set up and run an e-commerce store. The kinds of merchants who adopted it early tended to be smaller businesses selling directly online, which lined up with the value the product offered.

Firmographics help you answer the first question: Does this company look like the ones that succeed with us today?

Technographic data

Technographics reveal the tools, systems, and infrastructure a company already uses. This matters because your product doesn’t sit in isolation, it fits into an existing environment.

If your solution integrates with platforms like Shopify or Salesforce, companies already using those tools are naturally easier to onboard and more likely to see immediate value.

Technographics help you identify companies that are structurally prepared for your product.

Behavioral and operational data

This is where the ICP becomes sharper. Behaviour tells you how a company buys, how decisions are made, and what triggers action.

Some companies make quick, collaborative decisions; others take months of reviews and approvals. Some act immediately when a problem emerges; others wait until the issue becomes too big to ignore.

These patterns determine whether a company will move through your pipeline smoothly, or slowly.

Pain points and goals

Finally, the most important layer: what the company is trying to fix or achieve.

Two companies may look identical on paper, but only one may feel the urgency your product solves. When you understand the real pain points and the outcomes your best customers care about, you can identify prospects who are not just a fit, but ready.

Together, these building blocks give you a multi-dimensional view of your ideal customer. The goal is to identify the organizations that don’t just match your filters, but match your success patterns.

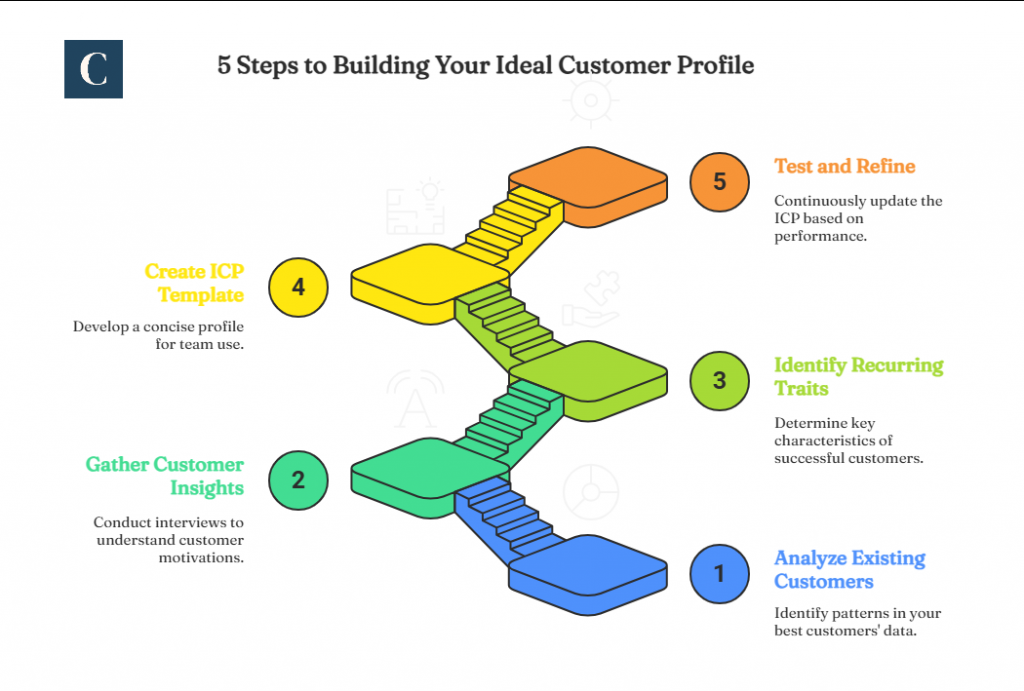

How to Build Your Ideal Customer Profile Step by Step

Start with your best existing customers

The clearest picture of your ideal customer is already in your data. Begin by looking at the companies that adopt quickly, stay the longest, grow the most, and require the least hand-holding. These accounts reveal patterns your team may not notice day-to-day, like industry clusters, common team sizes, familiar organisational structures, or shared moments of urgency.

Pull this information from your CRM, product usage data, renewal records, and any performance dashboards you have. The goal here isn’t to create a perfect model, but to see what your strongest customers have in common.

A helpful reminder: avoid choosing customers based on brand recognition or personal preference. The companies with the biggest names aren’t always the ones that actually succeed with you. Anchor your ICP in what’s real, not what looks impressive.

Talk to customers and customer-facing teams

Data gives you the “what,” but conversations give you the “why.” Speak with your most successful customers and ask questions about their decision process, their frustrations before buying, and the internal pressures that pushed them to act. These marketing insights often reveal factors that don’t appear in firmographics, like the presence of a change-driven leader, a recent restructuring, or a specific operational bottleneck.

Sales, support, and customer success teams add another layer. They know which accounts felt smooth from the first call and which ones drained time. Their observations help you avoid building an ICP in isolation, and prevent the common mistake of relying only on internal assumptions.

Identify patterns and recurring traits

Once you have the data and the stories, look for the traits that appear again and again. Maybe your strongest customers share the same procurement pace, or they all use a certain tool, or they tend to hit a specific growth milestone, like a Series A or a shift to a multi-office structure.

Choose the traits that truly matter, say three to five core characteristics that influence whether a company succeeds with your product.

Avoid making this list vague or overly broad. If the description could apply to half the market, it’s not an ICP; it’s a guess.

Map everything into a simple, one-page ICP template

Now turn your findings into a clear profile your team can use. A strong ICP includes firmographics, key pains, buying behaviour, internal dynamics, and the triggers that signal readiness.

The template should be simple enough that your sales and marketing teams can scan it quickly. If it takes several minutes to understand, it may not be used. Think of it as a practical tool, not a detailed report.

A concise narrative example helps here. For instance:

A mid-market SaaS company (50–300 employees) with a technical team struggling to manage fragmented workflows. Decisions are made quickly by a VP-level leader, especially after a quarter of rapid growth that exposes operational gaps. They use tools like Jira and Slack, making integrations seamless.

This example (short and concrete) shows what “ideal” looks like in context.

Test, refine, and keep it alive

An ICP only works if it stays relevant. As you apply it to campaigns, prospecting, and product decisions, you’ll learn which traits predict success and which ones don’t. Track conversion speed, sales cycle length, onboarding friction, and retention for ICP-fit accounts versus non-ICP accounts.

If you find that some traits don’t correlate with successful outcomes, update them. If you discover a new pattern, like companies responding well to a particular integration or trigger, add it.

The biggest mistake businesses make is treating an ICP like a finished document. It’s not. It’s a living guide that gets sharper as the market changes and your product evolves. A quarterly review is often enough to keep it fresh and useful.

With these steps, your ICP becomes more than a description, but a filter that helps your team focus on the companies most likely to succeed with you.

25 Tools That Help You Build and Validate Your ICP

The ICP process becomes far more accurate when you rely on tools that surface the right data and make patterns easier to spot. Here are some:

CRM systems

Your CRM is the foundation. Tools like HubSpot, Salesforce, or Pipedrive show you who is converting, churning, and expanding. This is where you pull the hard numbers: deal size, sales cycle length, product adoption, and renewal outcomes. A well-maintained CRM gives you the clearest view of which companies consistently succeed with your product.

Data enrichment platforms

Platforms such as Clearbit, Apollo, and ZoomInfo help you fill in the missing details, like industry classification, headcount, revenue estimates, tech stack, and other firmographic or technographic traits. This data makes your patterns clearer, especially when your internal records don’t tell the full story.

Product analytics tools

Mixpanel, Amplitude, and similar tools show how different types of customers use your product. When you compare usage patterns across accounts, you can easily see which traits correlate with deep adoption and long-term success. This is especially useful for identifying subtle differences between customers who look similar on paper but behave differently once onboarded.

Survey and interview tools

Tools like Fathom, Grain, Fireflies, and Otter help you capture clear notes from customer calls on platforms like Google Meet or Zoom. These notes make it easier to pull out the stories behind customer decisions. Survey tools like Google Forms and Typeform help you gather structured input at scale. Together, they reveal the triggers, frustrations, and internal pressures that never appear in your CRM.

ICP scorecards and qualification tools

Some teams use simple scoring templates inside their CRM. Others use tools like MadKudu or custom lead-scoring models in their marketing automation platform. These help you operationalise your ICP by giving every incoming lead a “fit score” based on your chosen traits.

Collaboration and documentation tools

Notion, Confluence, Miro, and Google Docs help you store your ICP in a way that’s easy to reference and update. Since your ICP evolves over time, it helps to keep it visible and accessible to every team.

AI tools

AI tools help you pull together the signals you gather across your research. ChatGPT, Perplexity, Google Gemini, Grok, and similar tools can scan call notes, summarise long interviews, compare traits across accounts, and flag patterns you may not see on your own.

These tools don’t replace your judgment, they simply make the process clearer, faster, and grounded in real evidence.

A Clear ICP Turns Random Wins Into Repeatable Growth

A clear ICP defines who you serve and just as importantly, who you don’t. That distinction gives your team space to focus, build with purpose, and stop stretching the business toward the wrong customers.

But a clear ICP only creates impact when the right companies come across your message again and again. Many teams never see that benefit because their content and search footprint don’t reflect the clarity of their ICP.

Column helps fix that. We take your ICP and shape it into search-friendly content, research, and social coverage that steadily brings the right companies into your orbit. If you want your strongest prospects to meet a clearer, more consistent version of your story, we can help.

Johnson is a Content Strategist at Column. He helps brands craft content that drives visibility and results. He studied Economics at the University of Ibadan and brings over years of experience in direct response marketing, combining strategy, creativity, and data-backed thinking.

Connect with him on LinkedIn.