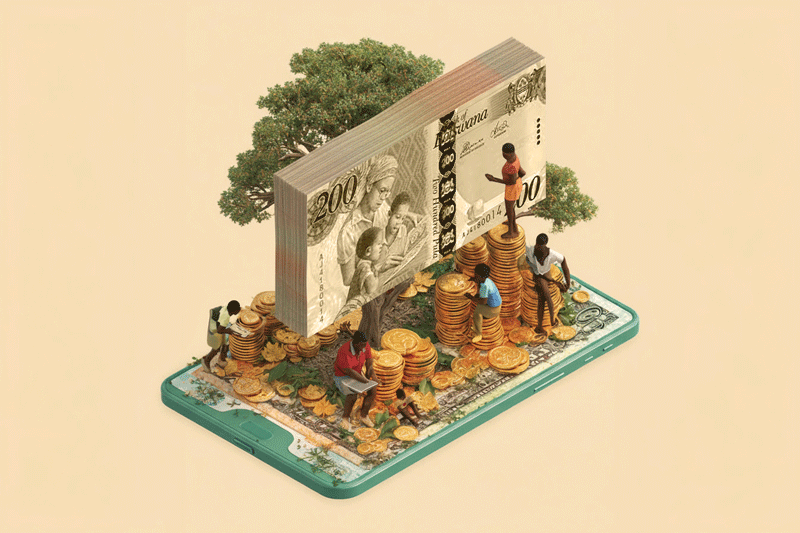

In Botswana, one of the most trusted banks isn’t a bank at all. It’s a motshelo — a circle of friends, family, or co-workers who pool money and take turns cashing out.

For decades, these circles have paid for school uniforms, funerals, groceries, and vacations. They run on nothing more than trust, yet they move millions of pula every year. No paperwork or contracts. Just commitment.

But trust has limits. Payments arrive late. Records vanish in notebooks. “Rats” eat said notebooks. Disputes break circles apart. And now, a younger generation is asking why a system so central to their lives still runs like it’s 1985.

That question is reshaping the future of metshelo (plural) in 2025, pushing it from living rooms and ledgers into apps and mobile money. This piece looks at how one of Botswana’s oldest financial traditions is being forced to adapt, and what it will take to carry trust into the digital age.

Where the Motshelo System Struggles

A 2025 survey we ran revealed the same complaints across groups: late contributions, poor record-keeping, and no real way to enforce agreements. When someone skips a payment, the entire circle stumbles. When money is mismanaged or misused, friendships and families can fracture. A system built to unite can just as easily divide.

Record keeping is perhaps the most fragile link. Many groups still rely on notebooks, WhatsApp chats, or spreadsheets to track contributions, and gaps in these systems can easily lead to disputes. With no formal enforcement, missed or late payments put the entire circle at risk.

Then there’s transparency. Members may not always know the exact state of the pool, who has repaid, or when payouts will be made. Add these small frictions together, and the picture is clear: motshelo still works, but it is leaking at the seams.

For younger members used to instant bank alerts and automated reminders, this gap between expectation and reality is hard to ignore.

Appetite for a Digital Motshelo Future

If the cracks are obvious, so is the appetite for change. When asked about the idea of a digital motshelo platform, more than half of respondents agreed fully, rating it 10 out of 10.

What they want is clear. Automated reminders to keep members accountable. Transparent record keeping so no one has to argue about who paid what. Loan and repayment tools to formalize borrowing. Integration with mobile money so contributions can move as smoothly as airtime. Even features like credit scoring and analytics made the wish list.

The voices from the survey capture the mood: “Anything for convenience and efficiency — sign me up.” “Not everyone is good at Excel, and the manual way of using books is outdated.” This is not about chasing shiny apps, but fixing everyday pain points that erode trust.

In short, the need is there, and so is the intent to pay. Over 80 percent of respondents said they’d subscribe, most at around P5 a month. For a practice rooted in free trust, that’s a telling signal of how much easier management is worth.

The Cultural Risks of Digital Motshelo

But enthusiasm has limits. For every respondent excited about a digital motshelo, another voiced unease.

Security topped the list of concerns. People worried about scams, hacking, and misuse of personal data. “Misuse of personal data, being hacked and losing all funds,” wrote one respondent. Another asked, “Will it be integrated into banking apps, [with] security protocols for data protection and privacy of members?” In a country where online fraud is rising, these are not abstract worries.

Then there’s culture. Some participants pushed back against digitization altogether: “Unnecessary. Motshelo is not purely transactional, it is part social.” For them, stripping the ritual down to numbers and notifications risks hollowing out its meaning.

Access is another hurdle. Rural members and older participants may not own smartphones or have stable internet connections. For them, the promise of digital sounds like exclusion.

The tension is clear: people want the efficiency of technology, but they don’t want to lose the trust and intimacy that make motshelo work. Solving that paradox is the central challenge for anyone trying to modernize the system.

Designing the Future of Motshelo

If motshelo is to survive the leap into the digital age, the path forward must be carefully designed. Here are the priorities to get right.

Transparency has to come first. A digital motshelo should give every member a clear view of contributions, payouts, and balances. Timestamped entries and downloadable statements would remove the guesswork that fuels disputes.

Enforcement tools matter too. Automated reminders, digital agreements, and simple penalty trackers can help groups hold each other accountable. While not the same as a legal contract, these tools set clear expectations.

Access cannot be ignored. Many Batswana still lack smartphones or stable internet. USSD menus and SMS updates would keep rural and older members included, ensuring the platform is truly national, not just urban.

Trust is fragile, so security must be airtight. PINs, encrypted data storage, and clear privacy policies will be essential. Partnerships with banks, cooperatives, or mobile money providers like Orange Money can also signal legitimacy.

Finally, design should feel local. Setswana and English language support, plain instructions, and examples that reflect real-life situations will build familiarity.

The opportunity is wide open. For fintech startups, banks, and regulators, motshelo offers a chance to blend tradition with innovation — and in doing so, create a financial tool that is both modern and unmistakably Botswana.

Motshelo Will Endure Only If It Evolves

The challenge is not whether motshelo should modernize, but how. If digitization strengthens transparency, accountability, and inclusion, it could make motshelo even more resilient. If it erodes the social glue that holds groups together, it could weaken the very thing it seeks to protect.

This article highlights only part of the story. The full State of Motshelo in Botswana 2025 report offers a detailed look at the challenges, opportunities, and future pathways for motshelo in Botswana.

It was featured across several countries, including Botswana (Weekend Post, 22-28 November 2025 edition), and Business Day Nigeria (23 September 2025).

Check out the full report today at columncontent.com/motshelo-report-2025.

Johnson is a Content Strategist at Column. He helps brands craft content that drives visibility and results. He studied Economics at the University of Ibadan and brings over years of experience in direct response marketing, combining strategy, creativity, and data-backed thinking.

Connect with him on LinkedIn.